EEA Citizen Moving to Norway for Work

March 24, 2018

Introduction

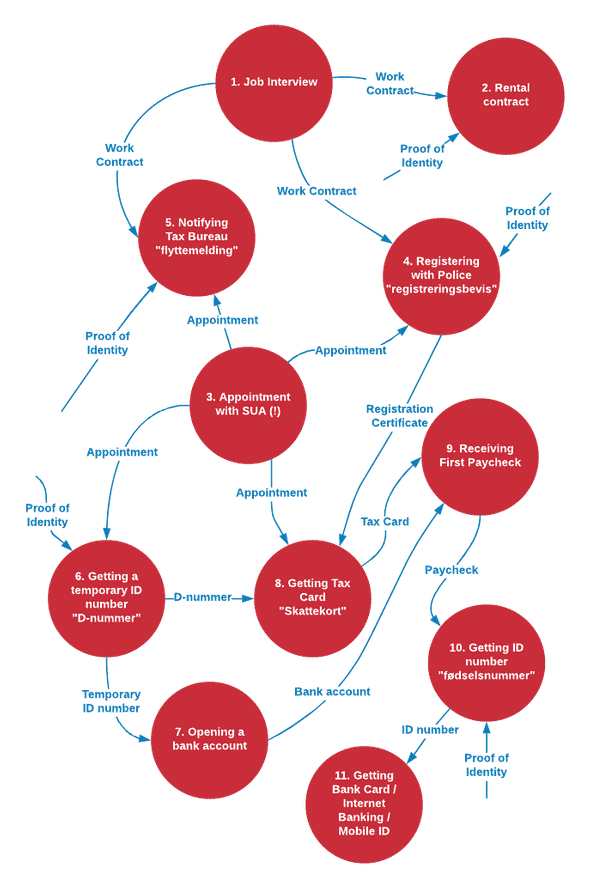

In the early part of 2017, I found work as a software developer in Trondheim. I did not live in Norway before, so this meant that I had to immigrate. Since I am a citizen of a EU member state, the process is simplified, but nevertheless, there are many steps to take.

In this post I am documenting my steps with a hope that someone else will find it useful. Not that this is not legal advice, and the requirements may be different in your situation, which is why I have added links to official resources.

Steps

Job Interview

To relocate for work, well, you need to have work. I applied to a multinational corperation, passed the interview process, and got an employment contract. The signed employment contract is the first thing you need for most anything, including renting an partment and obtaining registration certificate from police.

Resources

Rental Contract

When I moved to Norway, I stayed in AirBnB for the first week. It is cheaper than staying in a hotel, plus there is the advantage of staying with a local. However, even AirBnB can get expenive and staying in Norway will require a rental contract for 6 months or more. Fortunately for me, Trondheim is a university city, meaning there are many opportunities to rent a room in a kollektiv, which saves quite some money and is more social than living alone. Just be prepared to prove you will be able to pay the bills.

Resources

Appointment with SUA (Service Centre for Foreign Workers)

Once settled with basics, it’s time to get official! The end goal is to get your paycheck and have access to banking. Getting there will require mostly waiting for paperwork to be complete and mailed. The first step is to acquire right to live in Norway, which is done through police. This will require making an appointment on-line. I got my appointment in Service Centre for Foreign Workers, which is super convenient, because it combines both Politi and Skatteetaten.

Resources

Registering with Police (registreringsbevis)

As a citizen of an EU member, I technically already had the right to work in Norway, so this step consisted of showing my documents. In return, I got a certificate of registration, which I needed for next steps in Skatteetaten.

Resources

Notifying Tax Bureau (flyttemelding)

Skatteetaten was literally a few steps away, and all I had to do was getting a new queue number. The first document to fill was a notification to Skatteetaten, so they would know my address.

Resources

Temporary ID number (D-nummer)

Still there, I could also obtain a D-number, which is a temporary ID number for opening a bank account and getting the first pay check. Without a D-number, it would not be possible to get a permanent ID number.

The number is processed and sent by mail, so be prepared to wait.

Resources

Opening a Bank Account

About two weeks later, I finally had a D-number. That meant I could finally open a bank account! There are many banks to choose from, and there appears to be a strong competition in the market, so the banks tend to have very capable online banking solutions.

However, the banking is quite limited with only a D-nummer. It was not possible to get a bank card or internet banking. In addition, there were no cash transactions in the office in Sparebank1, so I was limited to money transfers.

Skattekort

Before the company can wire money to your account, they will need to know how much tax should be deducted from your paycheck. To know that, you will need to go back to Skatteetaten and ask for a skattekort. Once the skattekort is active, your employer can access it electronically.

Resources

Receiving First Paycheck

Now when you have a skattekort and it’s time to get your first paycheck, you will get a very important document - your payslip or lønnslipp. This document acts as evidence that your work contract was serious, you are capable of your work and the employer is able to pay you.

ID number (fødselsnummer)

At this point you have visited various offices, waited for documents, and you are finally at point to start wrapping up. One last document you will need from Skatteetaten is the national ID number. Like the D-number, this will be processed and mailed to you, so be prepared to wait.

Resources

Bank Card / Internet Banking / Mobile ID

Once you have the national ID number, you probably will not hear from Skatteetaten before the next tax return.

However, now you are ready to get a bank card, open internet banking, and to get a bank ID, the ubiquitous method of authentication. You will also be able to start a mobile phone subscription plan.

I was somewhat surprised to receive my bank card, but no PIN code. Apparently these are sent separately.

Conclusion

It may seem there are many steps, but most of the time I was just waiting for D number and ID number. The employees at Service Centre for Foreign Workers were super helpful, and I never felt overwhelmed. I hope your experience will be at least as smooth as mine, and that this information wil be useful in navigating the bureaucratic landscape, and that it will set proper expectations about waiting periods.